Tech & Business

5.15.2020

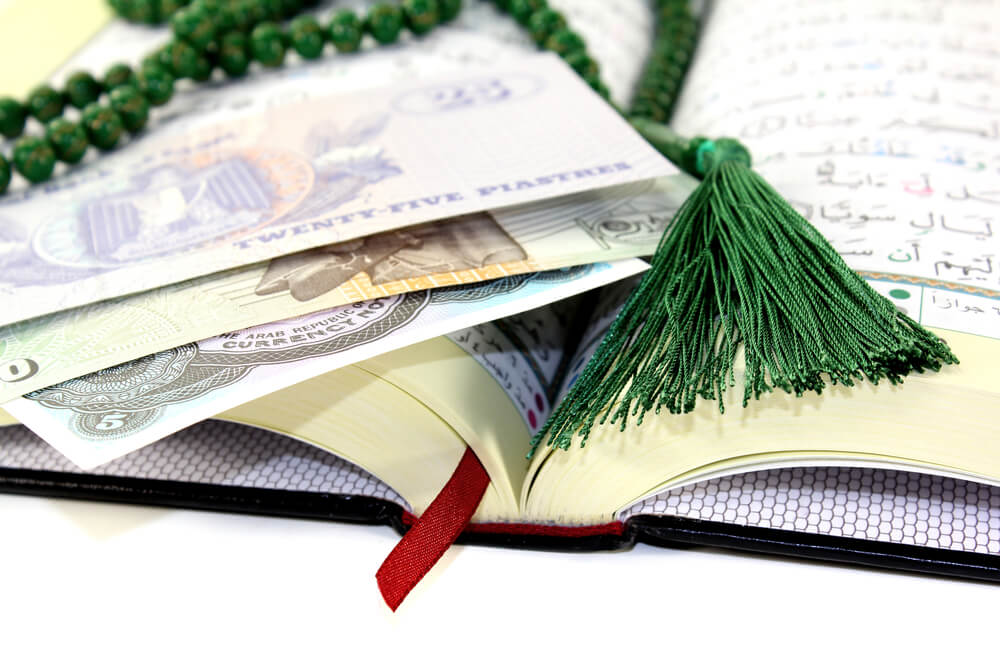

Islamic finance, a post-crisis ethical solution?

Islamic finance is a financial system in compliance with the principles of Islam. But its foundations, combining ethics and economics, are attracting more and more investors, beyond the Muslim community.

Islamic finance emerged in the late 1960s in Egypt with the first Islamic bank. In 2018, it represented 2 190 billion dollars (1 958 billion euros), according to a report by the Islamic Financial Services Commission (IFSB). Based on the Sharia law, it applies specific rules to all segments of finance (savings, investment and lending) including the prohibition of interest rates, speculation, illegal sectors such as alcohol, pig farming or pornography and uncertainty in transactions.

Its goal is to encourage the real economy but also a fairer share of risks and profits between borrowers and lenders, through a more participative, fair and ethical perspective. Recently, Islamic finance also demonstrated its resilience in difficult times notably during the subprime crisis in 2008, unlike the traditional banking system. What about the current coronavirus crisis? Will Islamic finance emerge as an ethical alternative for investors to rebuild the world of tomorrow? We discussed the topic with Mehdi Benslimane, Global expansion strategist at Wahed, an international halal investment platform.

With Wahed, you are promoting halal investment or what you call ethical investment. How do you ensure this commitment to your clients?

With Wahed, you are promoting halal investment or what you call ethical investment. How do you ensure this commitment to your clients?

We have set up a system of filtering the investments made available to our clients, setting aside companies and investments that are considered illegal according to islam, and are harmful to the world. Among them are the banks, due to the interest rates they charge, but also the weapon and tobacco industries, just to name a few. For this, we rely on a committee of internationally recognized Muslim scholars who validate or reject the investments or products we present to them, based on criteria defined by a central institution based in Bahrain, which is in charge of setting the standards that the Islamic financial community must respect with its clients.

Did the current coronavirus crisis affect the Islamic finance market?

From a client perspective, we have obviously been impacted because of the market sensitivity inherent to any financial investment. But historically, Islamic investments have demonstrated to be resilient in times of crisis. And the fact that we don’t have any banks in our portfolio, for example, has been a positive thing for our company, as it is one of the sectors that has suffered the most during this period. We build portfolios that are diversified, including gold which is a legal investment in Islam and has always proven to be a safe haven in times of crisis. Beyond that, we also have investments in sukuk (Islamic bonds) which also continue to show good performance.

You offer minimum investments at a very low cost. Why?

When you look at performance trends over the last century, long-term investment has always remained efficient. This is why we want to make financial investment accessible to a greater number of people, to clients who are concerned about investing ethically but who couldn’t do so before, because of the inaccessibility of financial products previously reserved for a wealthy elite clientele. Today, if we provide a service Sharia compliant, our offering is increasingly attracting clients from outside the Muslim community because we have built an accessible platform and diversified portfolio committed to a more inclusive, ethical and efficient finance.

In your opinion, can Islamic finance attract more investors following the Covid-19 crisis?

I believe that we are going through great dimensional changes, and that the ecological, social and economic urgency around the world only reinforces the need to invest more responsibly. And Islamic finance can be a real driving force towards this direction.

popular