Tech & Business

2.28.2023

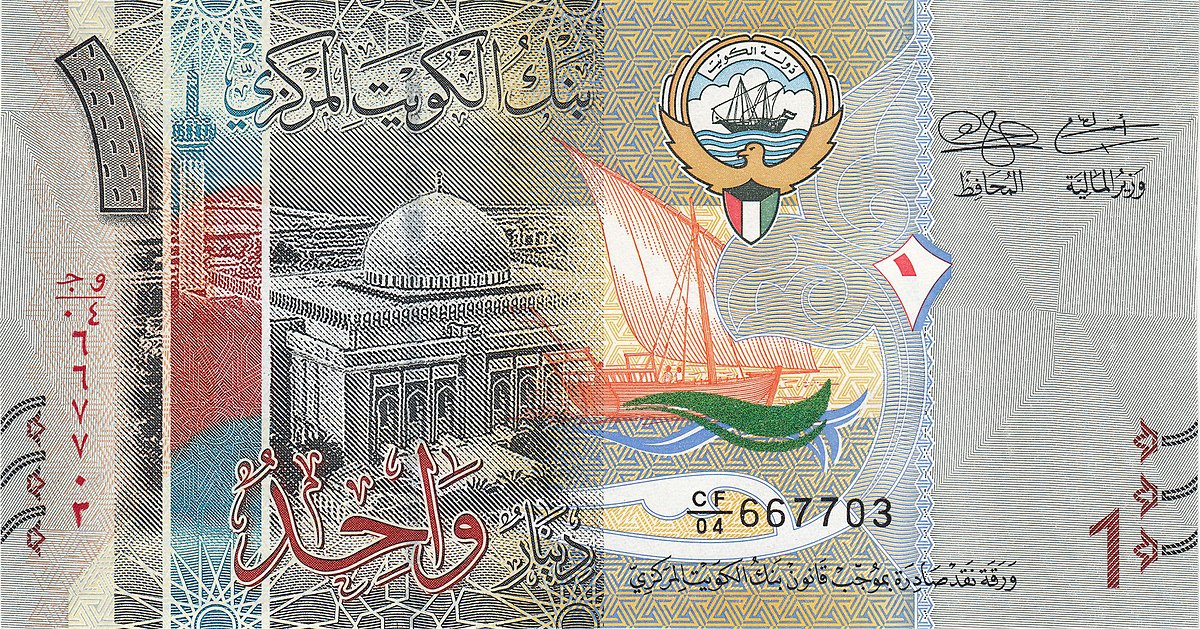

Kuwaiti, Bahraini, Jordanian dinar, Omani rial… Why are these currencies the strongest?

When it comes to currencies, some countries have more valuable ones than others. But why are the currencies of Kuwait, Bahrain, Oman and Jordan so highly ranked?

As of February 2023, the Kuwaiti Dinar (KWD) is the world’s highest-valued currency, with an exchange rate of approximately 3.30 US dollars per dinar. Similarly, the Bahraini Dinar is the second-highest-valued currency, with an exchange rate of approximately 2.65 US Dollars per dinar. The Omani Rial and the Jordanian Dinar are also highly valued, with exchange rates of approximately 2.60 and 1.41 US dollars per rial and dinar, respectively.

These currencies are highly valued for many reasons, including the fact that they are stable, as they are pegged to the U.S. dollar at favorable rates, which means that their value is tied to the dollar. This stability provides a sense of security to investors and companies operating internationally, as they can be assured that the value of their currency will not fluctuate significantly.

The political situation is also a major factor contributing to the value of a national currency. These Arab states have stable governments with little political turmoil. This stability helps maintain investor confidence, which in turn supports the value of their currencies.

Oil industries: an important element

For the Gulf states (Kuwait, Bahrain and Oman) in particular, an additional benefit comes into play, namely oil revenues that are used to develop microeconomic sectors and build infrastructure, thereby increasing the GDP of these countries. This allows these countries to keep their exchange rates high, which brings in more revenue as their exports are highly valued relative to their imports. In other words, the wealth generated by their oil industry makes their currencies highly coveted.

In addition, Kuwait, which has the most valuable currency in the world, benefits from a very active offshore investment fund, the KIO, or Kuwait Investment Office, based in London. In fact, the slightest news about the deals handled by the KIO can have an impact on the value of the currency. As a result, this fund helps to increase demand for the Kuwaiti dinar, which contributes to its good standing.

Voir cette publication sur Instagram

Diaspora remittances: One of Jordan’s strengths

Jordan also has some special advantages that are worth noting. For example, the country receives a high level of remittances from its diaspora, which are an important source of foreign exchange inflows and account for a significant share of the country’s GDP. These inflows serve to strengthen Jordan’s external balance, which is beneficial to the monetary value of the monarchy.

Voir cette publication sur Instagram

Why is it not the case for other Gulf countries?

But one might ask why the currencies of Saudi Arabia, the UAE and Qatar are less valuable than those of these 4 countries, when Saudi Arabia, the UAE and Qatar are also stable, with some of the strongest economies in the world.

The truth is, the financial history of Kuwait, Oman, Bahrain and Jordan has much to do with these countries having highly valued currencies.

These four countries pegged their currencies to other powerful ones, primarily the pound sterling and later the US dollar, at rates that gave them a considerable advantage over other countries, including their neighbors. In the case of Saudi Arabia, the United Arab Emirates and Qatar, their currencies are descended from other British colonial currencies such as those based on the Indian rupee or the Maria Theresa Thaler. As a result, when all these currencies switched to the U.S. dollar, the currencies of Kuwait, Oman, Bahrain and Jordan, which are descended from the British pound, had a considerable initial advantage that was maintained by the macroeconomic stability of these states.

For example, in 1980, when the Bahraini dinar was pegged to the International Monetary Fund (IMF) SDR, it was valued at a rate of US $1 = BHD 0.376, while in 1986 the Saudi riyal was pegged at a rate of US $1 = SAR 3.745.

popular